Trading in local currencies has already started — and lays the groundwork for facilitating BRICS transactions in gold

Recent progress made in streamlining trade in local currencies has brought Moscow and Beijing closer to creating a financial architecture that could facilitate transactions in gold.

As we reported last week, Moscow and Beijing took another step towards de-dollarization with the opening of a yuan clearing bank in Russia. And earlier this month Russia’s Central Bank opened its first-ever foreign branch in Beijing to allow for better communication between Russian and Chinese financial authorities.

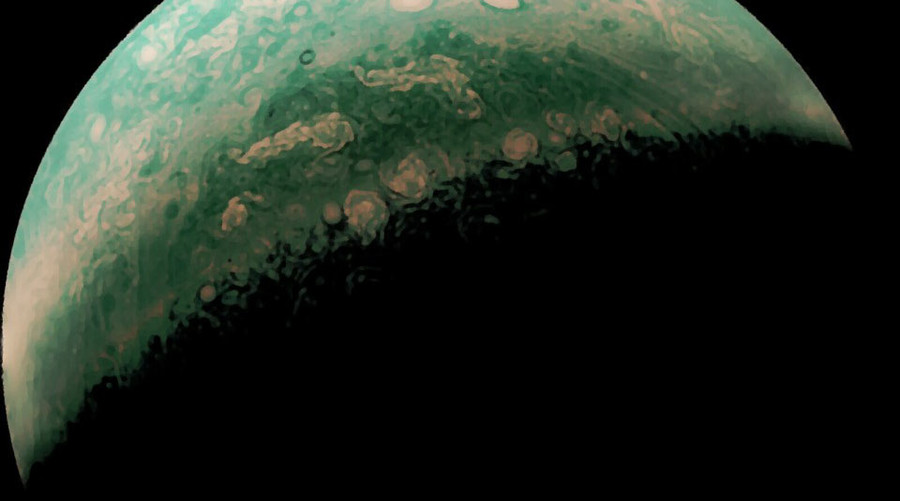

China & India’s Gold

According to an article published yesterday by Sputnik, progress made in promoting bilateral trade in yuan is the first step towards an even more ambitions plan — using gold to make transactions:

- The clearing center is one of a range of measures the People’s Bank of China and the Russian Central Bank have been looking at to deepen their co-operation. […]

- One measure under consideration is the joint organization of trade in gold. In recent years, China and Russia have been the world’s most active buyers of the precious metal.

- On a visit to China last year, deputy head of the Russian Central Bank Sergey Shvetsov said that the two countries want to facilitate more transactions in gold between the two countries.

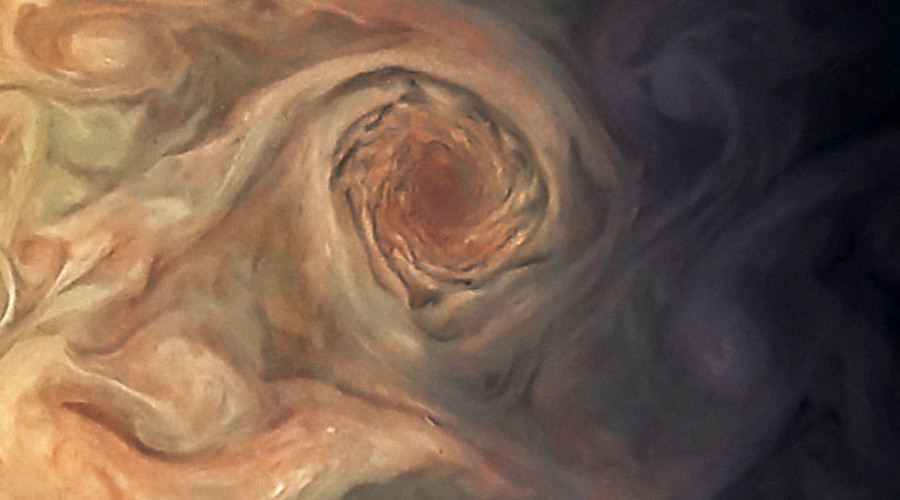

Russian Gold 2017

The possibility of trading in gold has been discussed by Russian officials over the last year. Last April, First Deputy Governor of the Russian Central Bank Sergey Shvetsov told TASS:

“BRICS countries are large economies with large reserves of gold and an impressive volume of production and consumption of this precious metal. In China, the gold trade is conducted in Shanghai, in Russia it is in Moscow. Our idea is to create a link between the two cities in order to increase trade between the two markets.”